Salary Structure

What is Salary Structure?

A salary structure is a clear framework that defines how employees are paid, including base salary, bonuses, incentives, and benefits, based on role, experience, and seniority. It ensures fairness, consistency, and transparency, helping companies attract top talent, retain employees, and motivate high performance. With defined salary ranges and progression, both employers and employees can easily understand compensation expectations.

Benefits of Salary Structure:

Fairness & Transparency

Attracts Top Talent

Employee Motivation

Budget Control

Consistency in Decisions

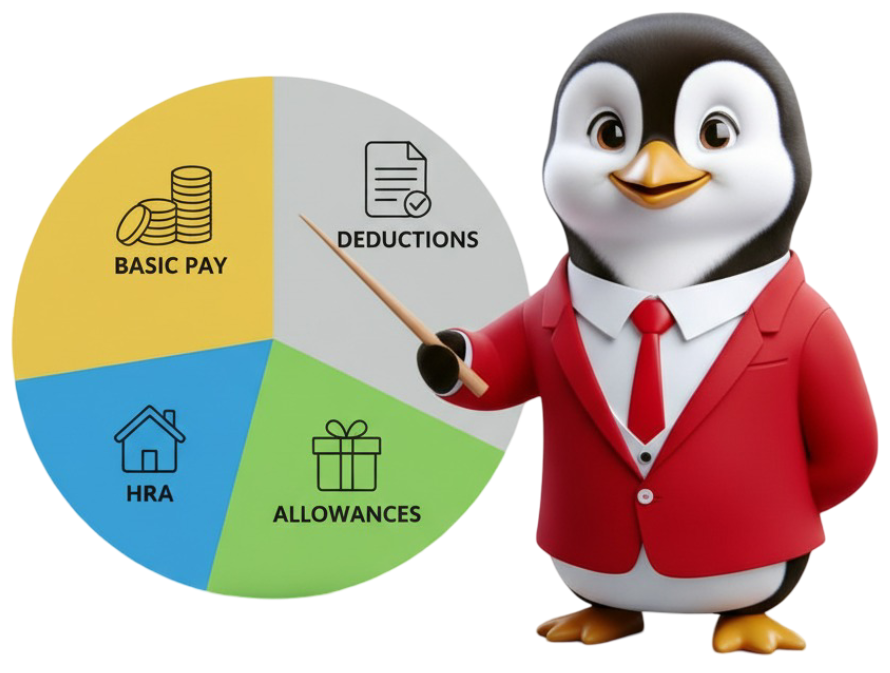

Key Elements of a Salary Structure

A salary structure is usually built around four components: base pay, allowances, incentives, and benefits. These elements are aligned with job roles, seniority, and performance levels to ensure fairness and clarity. When combined thoughtfully, they give employees a clear view of their earnings and growth path while helping companies maintain consistency and control. A well-balanced structure also supports compliance with labor laws and keeps payroll planning more predictable. Over time, this framework becomes a tool for both motivating employees and strengthening business stability.

What Happens in the Absence of a Good Salary Structure ?

High Employee Turnover

When employees feel undervalued, they’re more likely to leave for better opportunities. This constant churn can drain your resources and disrupt team dynamics. Happy employees stay, so make them feel valued!

Compliance Breaches

Ignoring local tax and labor laws can lead to costly penalties. Compliance is not just a box to check; it’s essential for your business’s reputation and financial health. Stay on the right side of the law to avoid unnecessary headaches!

Resource Misallocation

Poor payroll management can divert resources away from what really matters: your core business. When funds and attention shift away, productivity takes a hit. Focus on effective payroll solutions to keep your business thriving!

Don’t let your business sink! A weak salary plan can threaten your growth.

Choose HRTailor for a winning salary structure that drives success!

Call Us On

How Do HRTailor Online Salary Structure Help?

At HRTailor, we specialize in designing tailored salary structures that fit your business needs. Our process covers everything from analysis to implementation, ensuring we provide customized solutions based on your specific requirements. Our process covers:

Basic Salary:

The amount of basic salary is a firm foundation for any pay system, thereby affecting all other salary-related factors. The principle is that this pay form is the primary compensation that the employee receives, directly contacted with additional privileges.

Leave Travel Allowance (LTA):

LTA is the best way for the employee to obtain tax-free advantages and the employer to get an available way of providing benefits to their subordinates and promotes a healthy work-life balance and encourages time off.

Fuel and Maintenance Reimbursement:

Fuel and maintenance reimbursement plan is the best way to aid employees in covering their transportation costs when they use personal automobiles for job-related purposes. This benefit ensures that they aren’t burdened by expenses incurred while fulfilling job responsibilities.

House Rent Allowance:

Assists your employees to afford quality accommodation by reducing the amount that can be taxed. As an organization, this allows you to help without being liable to high tax payments.

Communication Allowance:

Ensures your employees receive timely communication allowances. This comes in the form of a refund for the telecommunication costs they have incurred in the course of their work. This is beneficial to the employees as they don’t have to worry about the cost of the call and the data.

Training/Academic Pursuit Allowance:

Offers your employees refresher courses and motivates them to undertake other related courses. This will be beneficial to your organization as the number of qualified staff will have gone up.

Subscriptions and Memberships:

Subscriptions and memberships provide valuable opportunities for employees to join industry associations that enhance their professional lives. This benefit helps them stay informed and connected, boosting their knowledge and expanding their network.

Special Allowances:

Special allowances are flexible benefits designed to meet the specific needs of the business or its employees. This adaptability allows you to address unique situations while demonstrating to employees that you value their individual circumstances.

Employees’ State Insurance (ESIC) and Provident Fund (PF) are vital social security measures that protect employees and ensure compliance for businesses. While ESIC provides medical and financial support during unforeseen situations, PF helps employees build long-term savings for retirement. Together, they safeguard workers’ present needs and future security, while keeping organizations aligned with legal requirements.

Professional Tax is determined by local regulations, and we ensure it is calculated accurately to prevent any penalties. By managing this tax properly, you maintain your business’s good standing with local authorities.

What Makes HRTailor Different?

HRTailor specializes in designing salary structures. We provide compliant and employee-centric salary structures.

Which are adjustable to meet the growing needs of your business.

Customized Salary Structure

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Fully Compliant

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Transparency

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Seamless Integration

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Safeguard Your Business with a Well-Thought-Out Salary Structure

A good salary structure will boost productivity by increasing employee satisfaction and engagement. Use HRTailor to avoid pitfalls by ensuring compliance and management. Get in touch with HRTailor and Discover how we can help you in making a truly

genuine salary structure that fits your business needs.